ON FEBRUARY 24, PRESIDENT TRUMP IS

EXPECTED TO SIGN HIS FINAL ONE — EVER!

Ian King here with some very big news.

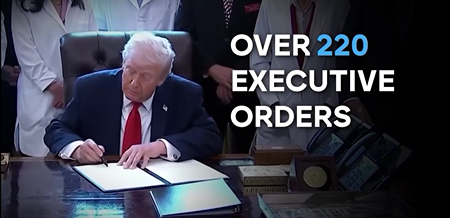

After 220 Executive Orders in one year. And with nearly three full years left in office…

I have learned the unthinkable…

On February 24th, President Trump is expected to issue what I believe will be his FINAL Executive Order.

I know that sounds crazy …

I didn’t believe it myself.

But then I saw all the details of the leak — coming directly from inside the White House — and I knew right away this was going to be a huge and shocking announcement.

I was able to get the full story for you here.

Regards,

Ian King

Chief Strategist, Strategic Fortunes

Bank of America's Rock-Bottom P/E and 25% Upside Potential

Authored by Sam Quirke. First Published: 1/28/2026.

Key Points

- Bank of America trades at one of the lowest valuations among mega-cap stocks, even after a strong rally over the past year.

- A recent pullback has provided some time to take profits without breaking the broader uptrend, improving the risk-reward setup.

- Recently refreshed price targets point to solid upside potential heading into February.

Financial giant Bank of America Corp (NYSE: BAC) did almost everything right in 2025. The stock rallied sharply, hit a record high and finished the year strong. It even pushed to fresh all-time highs in early January, and bulls looked set to remain in control heading into 2026.

Then a pullback gathered pace after the bank's earnings report two weeks ago, trimming roughly 10% from the share price. On the surface, it hasn't been a great start to the year. Zoom out, though, and the picture is less concerning: the broader uptrend remains intact, selling pressure is beginning to look tired, and the stock's valuation has reset to one of the lowest price-to-earnings (P/E) multiples among mega-cap stocks today.

The biggest scam in the history of gold markets is unwinding (Ad)

There are 90 paper gold claims for every real ounce in COMEX vaults. Ninety promises, one ounce of metal. It's like musical chairs with 90 players and one chair. COMEX gold inventory dropped 25 percent last year alone as gold flows East to Shanghai, Mumbai, and Moscow. On March 31st, contract holders can demand delivery. When similar situations arose in the past, markets closed and rules changed. Paper holders got crushed while mining stock holders made fortunes. One stock sits at the center of this crisis.

Get the full story on this opportunity now.With many analysts rating the shares a Buy and several calling for upside of at least 25%, Bank of America is quietly shaping up as one of the more interesting large-cap setups heading into February. Let's take a closer look.

An Attractive Valuation

With a current P/E below 14, Bank of America's multiple is the lowest among mega-cap stocks right now. For investors who view the recent selling as a pause rather than the start of a reversal, that creates an attractive buy-the-dip opportunity.

When a stock falls in the week before a quarterly earnings report and then continues to decline after the release, you'd expect the report to be weak. Instead, Bank of America delivered another solid quarter, topping revenue and earnings expectations, demonstrating operating leverage, and reporting provisions for credit losses well below forecasts.

That suggests January's pullback was driven more by broader market forces than by any deterioration in the bank's fundamentals.

Rising geopolitical tensions have weighed on equities recently, and it appears Bank of America's shares were caught up in that shift to risk-off sentiment.

The lack of major follow-through selling this week further supports the view that the weakness was macro-driven. With the uptrend intact and selling pressure easing, the stock's lower P/E makes for an interesting risk/reward profile.

Analysts See Meaningful Upside From Here

Adding to the argument that the market may be too pessimistic, a number of analysts are bullish on Bank of America. Goldman Sachs recently reiterated its Buy rating and raised its price target to $67.

That call mirrors moves from Morgan Stanley and TD Cowen, both of which reiterated Buy (or equivalent) ratings earlier this month with price targets near $64. Those targets imply more than 25% upside from current levels—not insignificant for a stock trading at a rock-bottom valuation.

Risks Remain, But Are Largely Known

There are still headwinds as we move into February. One notable risk is the proposed 10% cap on credit card interest rates announced earlier this month. If implemented, it could pressure profitability across parts of the consumer banking business.

That risk has been widely discussed, and the recent pullback likely reflects some of that uncertainty. In addition, Bank of America's diversified revenue base and scale provide a buffer that smaller peers may lack.

Still, bulls will need to show strength in the coming sessions to prove control. The stock hit a recent low last week and has bounced since, but it remains to be seen whether the $52 level will hold as support.

If that floor holds, don't be surprised to see the shares trade into the upper $50s or mid-$60s by the end of the quarter.

This email is a sponsored email for Banyan Hill Publishing, a third-party advertiser of MarketBeat. Why did I receive this email message?.

If you would like to unsubscribe from receiving offers for Strategic Fortunes, please click here.

If you need help with your account, please contact our South Dakota based support team at contact@marketbeat.com.

If you would no longer like to receive promotional emails from MarketBeat advertisers, you can unsubscribe or manage your mailing preferences here.

Copyright 2006-2026 MarketBeat Media, LLC.

345 N Reid Place, Suite 620, Sioux Falls, S.D. 57103. USA..

No comments:

Post a Comment