|

World News

Monday, March 9, 2026

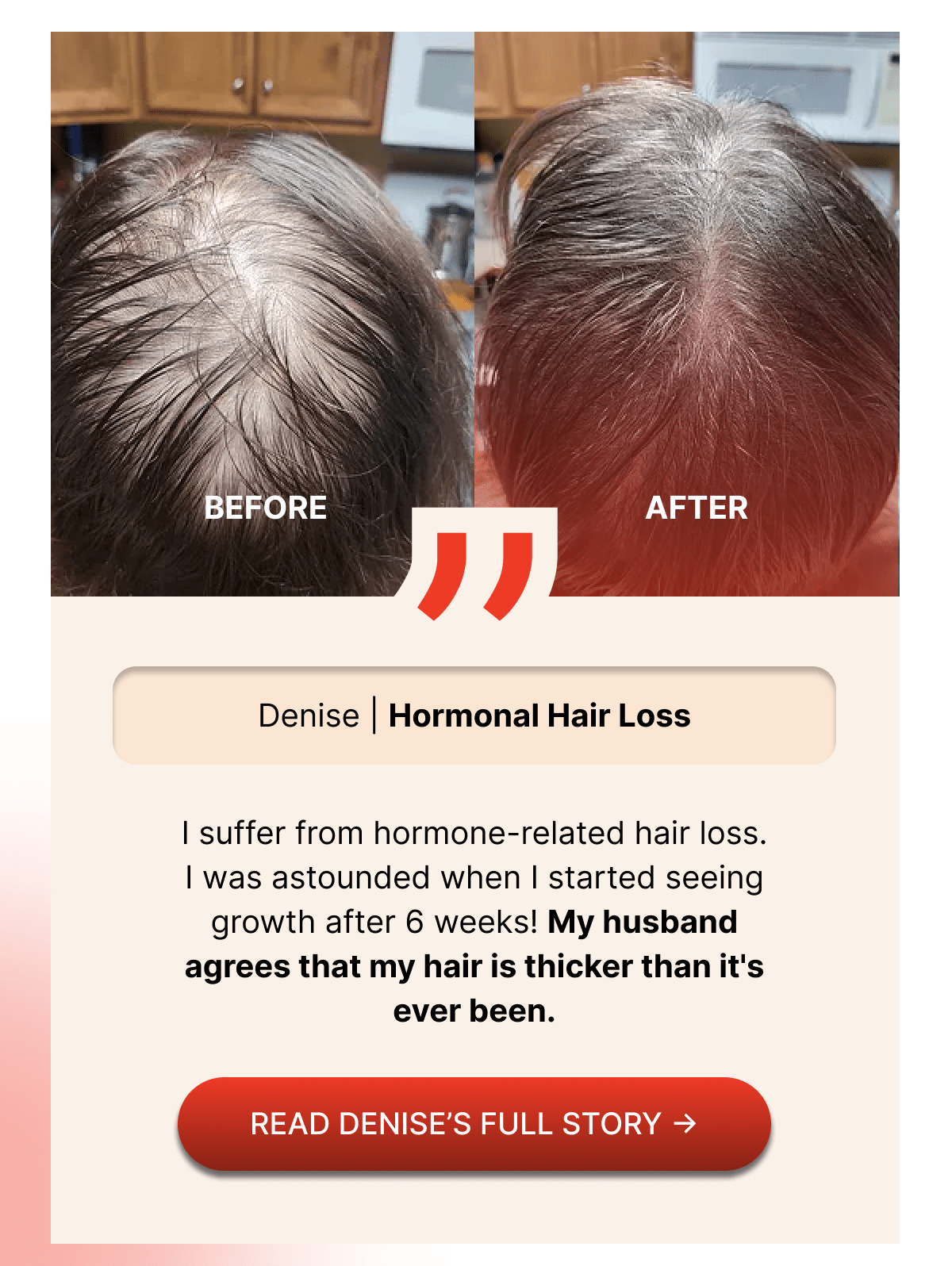

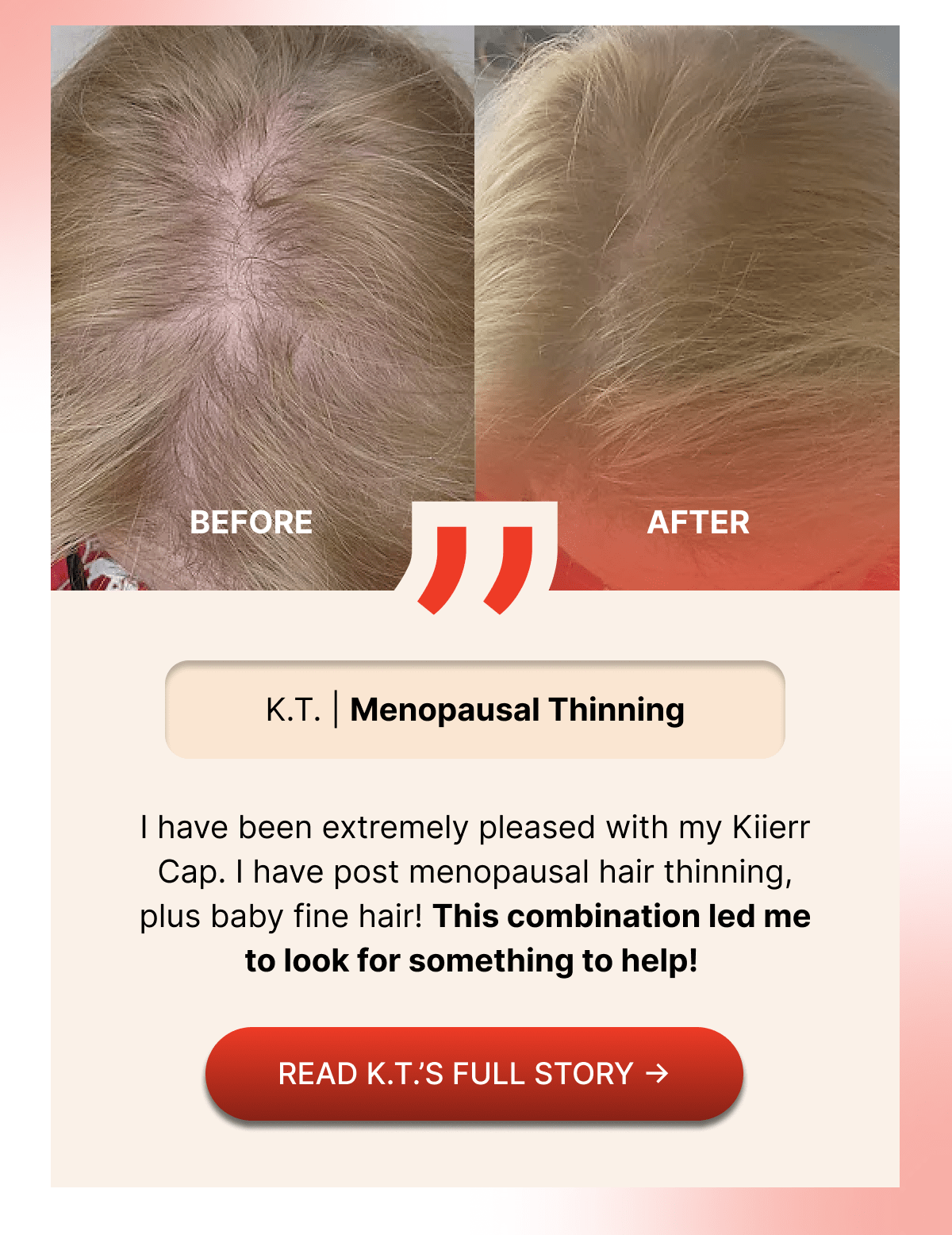

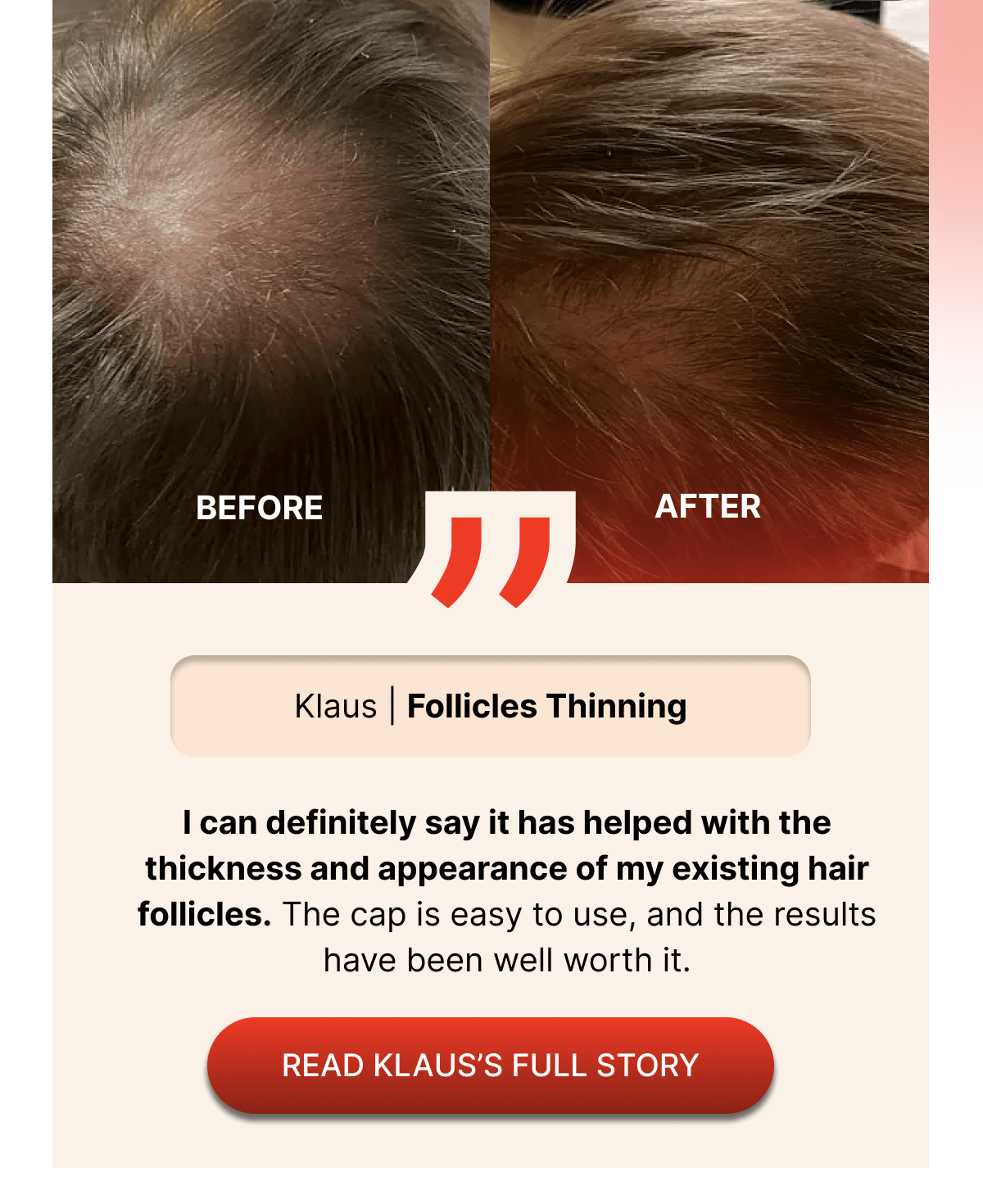

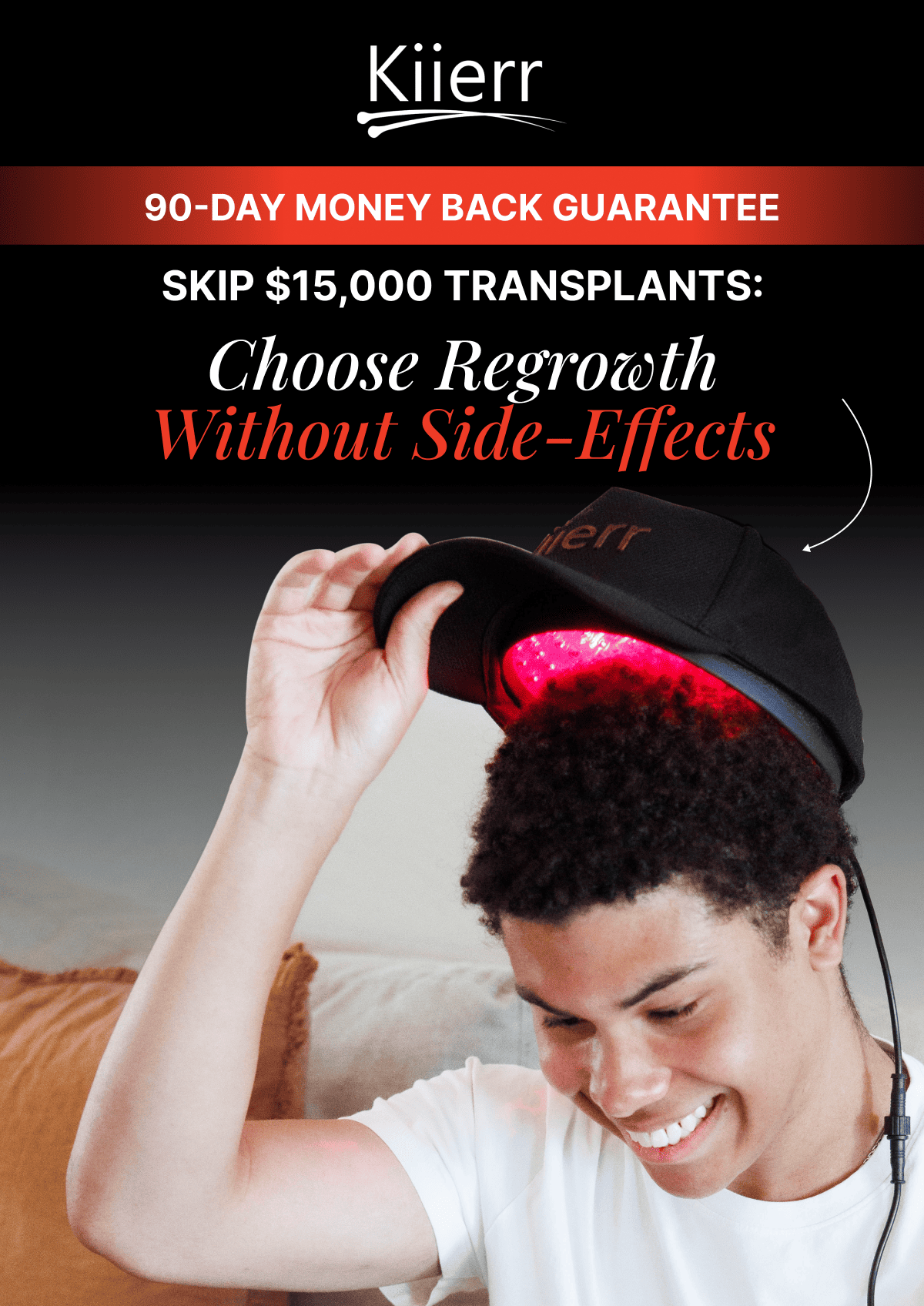

Regrowth without any side-effects?

Liberal media covers for Saturday's NYC terror attack suspects — then the facts come out

|

"Gold Shock" coming March 31st

Mark this date:

On March 31st, 2026...

The biggest scam in the history of gold markets will be exposed...

It's the math that keeps bankers up at night...

The gold chart that has Wall Street shaking in its loafers...

That's the day the public will see that their gold ETFs are nothing but paper...

The rush from ETFs to real assets will be unlike anything we've seen in 300 years.

One stock on the receiving end of this epic transfer, is set to explode 1,000% as ETF holders could get wiped out.

This isn't a hunch - it's math.

See all the evidence for yourself right here and take your position before it's too late.

"The Buck Stops Here,"

Dylan Jovine

Radioactive Returns: Geopolitics and AI Fuel a Nuclear Supercycle

Submitted by Jeffrey Neal Johnson. First Published: 2/24/2026.

Key Points

- Vistra Corp. capitalizes on the urgent demand for clean baseload power by signing significant long-term agreements to support massive data center operations.

- Cameco Corporation expands its influence in the nuclear fuel cycle through high-grade mining assets and strategic partnerships for new reactor deployment.

- Growing global demand for secure, reliable energy infrastructure supports a sustained bullish trend for established upstream and downstream nuclear companies.

- Special Report: [Sponsorship-Ad-6-Format3]

Recent diplomatic reports indicate Russia is actively marketing and offering nuclear power infrastructure to countries such as Serbia. While this may look like routine trade, it signals a growing fracture in the global energy market. Energy infrastructure has become a geopolitical chess piece, forcing the United States and its allies to rethink how they secure their power grids.

For decades, Western nations relied on globalized supply chains to meet energy needs. Russia's aggressive moves are pushing them toward onshoring and prioritizing domestic energy independence and security. In 2026, energy security has become synonymous with national security.

Have $500? Invest in Elon's AI Masterplan (Ad)

What if you could claim a stake in what's set to be the biggest IPO ever… starting with just $500?

Everyone is talking about Elon Musk's SpaceX IPO.

At the same time, a second, perhaps more powerful force is reshaping the electricity market: artificial intelligence (AI). Data centers—the massive physical facilities that power the internet, cloud computing, and AI models—consume electricity at unprecedented rates. Unlike a factory that might shut down at 5:00 p.m., data centers require baseload power: electricity delivered reliably 24 hours a day, seven days a week, regardless of the weather.

While renewables such as wind and solar are essential to the energy mix, they are intermittent; the sun doesn't always shine and the wind doesn't always blow. Nuclear energy remains the only scalable, carbon-free source capable of providing the constant, large-scale reliability Big Tech demands. The convergence of national security concerns and surging technological demand is creating a tailwind for established Western nuclear operators.

The Downstream Powerhouse: Vistra Corp.

Vistra Corp. (NYSE: VST) represents the downstream opportunity in this sector. As an integrated power company, Vistra generates and sells the actual electricity—the electrons—that power the grid and the data centers connected to it.

Understanding Vistra's investment case requires appreciating its economic moat. Building a new nuclear plant in the United States is a lengthy, costly process that often takes more than a decade to clear regulatory hurdles and finish construction. That reality gives Vistra a material advantage: the company already owns the second-largest competitive nuclear fleet in the country. These licensed, operational, grid-connected assets are scarce and increasingly valuable in a power-hungry world.

The 2,600 MW Signal

The theoretical value of Vistra's fleet became tangible on January 9, 2026, when the company announced a landmark agreement with Meta Platforms. This 20-year Power Purchase Agreement (PPA) covers more than 2,600 megawatts (MW) of capacity to supply the tech giant.

Crucially, the deal includes uprates—efficiency upgrades that allow existing plants to generate additional power without building new reactors from scratch. Uprates are the most cost-effective way to add capacity, and the agreement is evidence that major technology companies are willing to pay a premium for reliable, carbon-free nuclear energy to support their AI ambitions.

Earnings Watch: Q4 Forecast

Investors are closely watching Vistra as it prepares to report its fourth-quarter 2025 earnings on Thursday, Feb. 26, 2026. Expectations are elevated, reflecting the company's strong positioning.

- Earnings Per Share (EPS): Consensus estimates are approximately $2.51, implying a year-over-year increase of roughly 120%.

- Revenue: Analysts project revenue of about $5.34 billion.

Beyond the earnings print, Vistra has been aggressive about returning capital to shareholders—a key metric for long-term investors. Since November 2021, the company has repurchased roughly 30% of its outstanding shares, shrinking the float and increasing value per remaining share. The company also recently declared a quarterly dividend of about $0.23 per share, further rewarding holders.

Currently trading near $167, the stock has consolidated after a strong run, suggesting the market is pausing for the upcoming earnings report to confirm the company's growth trajectory before making the next move.

The Upstream Titan: Cameco Corporation

While Vistra sells the power, Cameco Corporation (NYSE: CCJ) supplies the essential fuel and technology that create it. Cameco represents the upstream investment opportunity.

As Western utilities move away from Russian fuel services amid geopolitical risk, they are signing long-term contracts with suppliers in stable jurisdictions. Cameco operates world-class mines in Canada, including McArthur River and Cigar Lake—some of the highest-grade uranium deposits on the planet—positioning the company to benefit from this supply-chain shift.

The $80 Billion Backstop

Cameco has evolved beyond mining into a broader nuclear-technology infrastructure player. In October 2025, a strategic partnership involving Cameco, Brookfield, Westinghouse, and the U.S. Department of Commerce was announced, aiming to deploy $80 billion in new Westinghouse AP1000 reactors.

That collaboration is significant because it effectively brings the financial and diplomatic weight of the U.S. government to bear on rebuilding Western nuclear capacity. It signals that policymakers view Cameco and Westinghouse as critical partners in restoring domestic nuclear infrastructure.

The Contract Fortress: 230 Million Pounds

Cameco reported solid fourth-quarter results on Feb. 13, 2026, showing operational resilience. The company posted EPS of $0.36, beating analyst estimates of $0.29, and revenue of about $875 million, also above expectations.

Perhaps most important for risk-conscious investors, Cameco currently has roughly 230 million pounds of uranium committed under long-term contracts. That contract book acts as a fortress, insulating the company from short-term spot-price swings while guaranteeing future revenue. After the earnings beat, GLJ Research reiterated a Buy rating and raised its price target from $100.00 to $171.20, reflecting strong confidence in the company's outlook.

The Nuclear Renaissance: Two Paths, One Destination

Vistra Corp. and Cameco Corporation offer two distinct but complementary ways to play the nuclear resurgence. Vistra provides exposure to near-term cash flows from selling power to AI data centers and the wider grid. Cameco offers exposure to rising uranium prices and the long-term buildout of reactor infrastructure.

With the uranium spot price near $89 per pound and political momentum favoring domestic energy security, the sector appears positioned for a structural bull market. In an era driven by algorithms and defined by geopolitical borders, nuclear energy is shifting from a contrarian bet to a core component of modern infrastructure portfolios.

IBM's Steep Drop on AI Fears May Be an Overreaction

By Jeffrey Neal Johnson. Date Posted: 2/25/2026.

Key Points

- International Business Machines consistently generates exceptional free cash flow to comfortably support ongoing corporate transformation and reliable shareholder dividend payouts.

- Strategic acquisitions strongly enhance hybrid cloud architecture and provide a robust foundation for future enterprise technology expansion.

- Proprietary artificial intelligence innovations allow clients to safely modernize their legacy code directly on highly secure mainframe platforms.

- Special Report: [Sponsorship-Ad-6-Format3]

A collision between cutting-edge artificial intelligence (AI) startups and legacy enterprise infrastructure wiped out billions in shareholder value. On Feb. 23, 2026, International Business Machines (NYSE: IBM) suffered its steepest single-day decline since 2000, with shares tumbling 13.2% and erasing roughly $30 billion in market capitalization in a matter of hours.

The trigger was a single product announcement from AI startup Anthropic. The company unveiled new features for Claude Code, including tools that claim to automate the modernization of COBOL — the decades-old language that still quietly powers large parts of the global financial system. Investors feared that automated code translation could instantly eliminate lucrative infrastructure and consulting revenues tied to maintaining those systems. That panic sparked a sectorwide sell-off, dragging down major IT service providers.

Have $500? Invest in Elon's AI Masterplan (Ad)

What if you could claim a stake in what's set to be the biggest IPO ever… starting with just $500?

Everyone is talking about Elon Musk's SpaceX IPO.

The dramatic sell-off, however, began to ebb quickly. The stock rebounded the following day, closing up 2.68% at $229.34 on heavy trading of more than 13.3 million shares. Major Wall Street analysts, including Wedbush and Evercore ISI, rushed to defend the stock, calling the rout an unwarranted overreaction and a buying opportunity for investors who understand enterprise technology realities.

Why AI Cannot Replace a Mainframe

Enterprise clients will not abandon mainframes simply because a new AI tool can translate legacy code into modern languages. There is a critical difference between translating code syntax and modernizing a deeply integrated hardware-software architecture.

The structural moat of the Z series mainframe remains intact. A basic software-as-a-service tool hosted on a public server cannot replicate the hardware-level guarantees required by the world's largest institutions. Current-generation mainframes are purpose-built from the silicon up to deliver unmatched transactional resilience:

- Massive Scale: A single system seamlessly processes 25 billion encrypted transactions per day.

- AI Speed: The platform delivers an astonishing 450 billion AI inferences per day with one-millisecond response times.

- Extreme Reliability: The hardware operates with up to eight nines of availability.

- Future-Proof Security: The system features quantum-safe encryption to protect against future cyber threats.

More than 90% of the world's credit card transactions flow through these specialized systems. Regulated entities — global banks, insurance firms and governments — are unlikely to move their most sensitive operational data to third-party public clouds because the data sovereignty, regulatory compliance and security risks are too high.

In fact, AI can strengthen this protective moat rather than erode it. The company already offers a proprietary generative AI tool, watsonx Code Assistant for Z, which lets clients refactor and modernize legacy code safely on the platform without sacrificing enterprise-grade security.

Pristine Financials Hidden in the Noise

The market panic largely obscured the company's underlying financial performance. Before the AI-driven sell-off, fourth-quarter 2025 results showed broad-based growth that beat Wall Street expectations:

- Earnings Beat: Adjusted earnings per share (EPS) of $4.52 topped consensus estimates of $4.33.

- Revenue Surge: Total fourth-quarter revenue reached $19.7 billion, a 12% year-over-year increase.

- Segment Strength: Growth was driven by a 14% rise in Software revenue and a 21% jump in Infrastructure revenue.

- Record Cash: Free cash flow for full-year 2025 hit a record $14.7 billion, up $2 billion year over year.

The business is growing and generating substantial cash independent of the market noise. The company's internal generative AI book of business now exceeds $12.5 billion — more than $10.5 billion in consulting and roughly $2 billion in software — underscoring successful monetization of AI within highly regulated enterprise environments.

Management is also deploying capital aggressively to strengthen the high-margin software portfolio. The strategic acquisitions of HashiCorp ($6.4 billion) and Confluent (NASDAQ: CFLT) ($11 billion) enhance the company's hybrid cloud capabilities. To further cement its AI position, the company recently announced a major collaboration with Deepgram to add advanced voice AI to its enterprise offerings.

A 3% Dividend Yield Built on Rock-Solid Cash

The sharp decline in IBM's share price compressed the stock's valuation. The trailing price-to-earnings ratio (P/E) has contracted to about 20.5, creating a more reasonable entry point than the premium earlier in the year. Because dividend yields move inversely to price, the pullback has pushed the dividend yield to approximately 2.93%.

Management preserves a 30-year track record of consecutive annual dividend increases. The payout is well supported by growing free cash flow detailed in the recent earnings report. For 2026, guidance calls for more than 5% constant-currency revenue growth, and management expects an additional $1 billion of free cash flow — signaling confidence in the company's ongoing transformation.

While the market focuses on short-term disruption narratives and flashy startup announcements, the underlying metrics tell a different story. The financials remain strong, and core infrastructure is far more defensible than basic code translation implies. For patient investors, the recent volatility has created a rare opportunity to buy shares of a profitable, cash-generating, entrenched technology leader at a meaningful discount.

This email message is a sponsored email provided by Behind the Markets, a third-party advertiser of InsiderTrades.com and MarketBeat.

If you have questions or concerns about your newsletter, please don't hesitate to contact MarketBeat's U.S. based support team at contact@marketbeat.com.

If you no longer wish to receive email from InsiderTrades.com, you can unsubscribe.

Copyright 2006-2026 MarketBeat Media, LLC. All rights reserved.

345 North Reid Place, Sixth Floor, Sioux Falls, S.D. 57103-7078. USA..

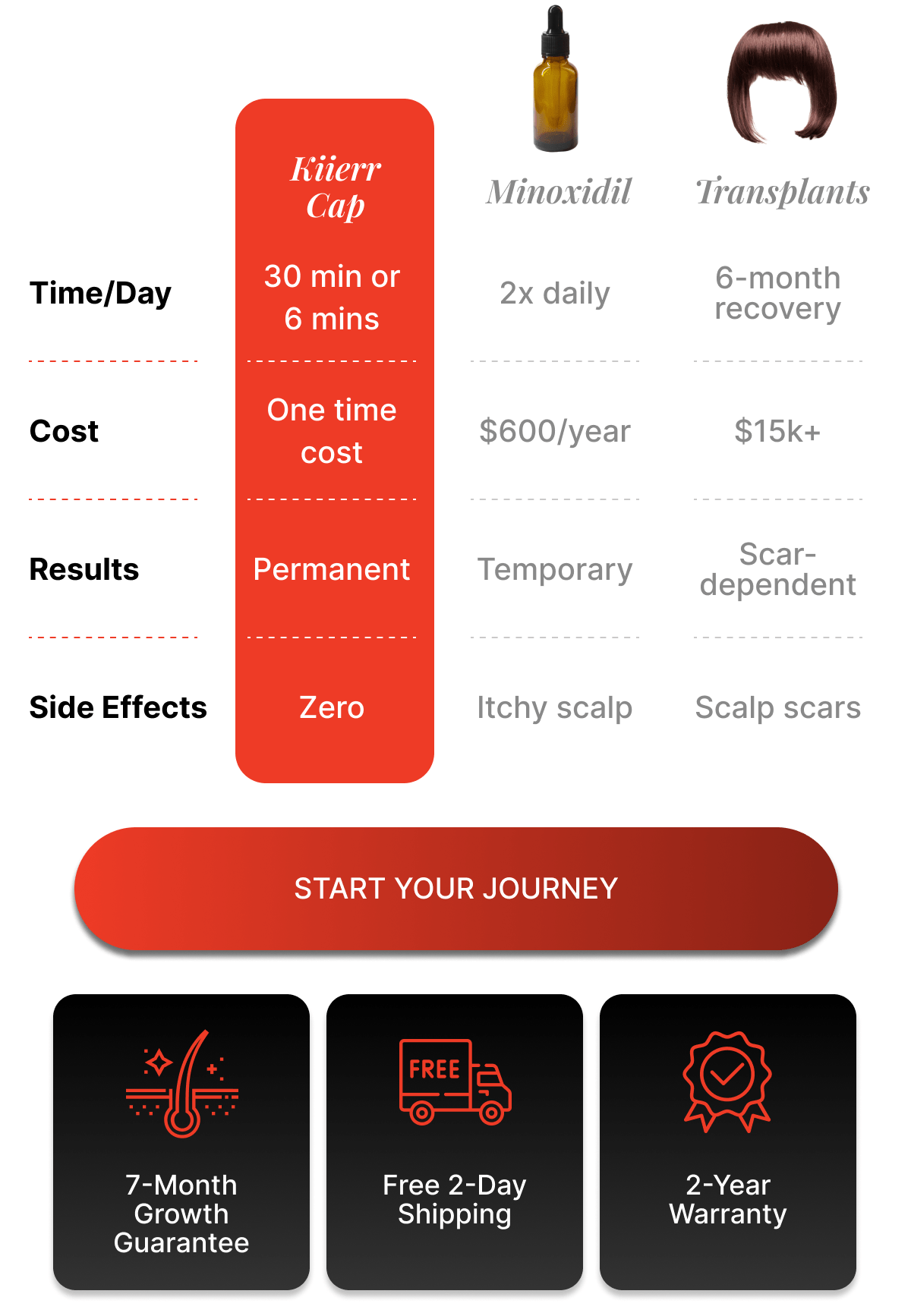

Regrowth without any side-effects?

Safe, predictable, and shockingly effective. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏...

-

1. Earnings flood: Investors will hear from a slew of corporate titans on Thursday. Alibaba, Blackstone, Boston Scientific, Conoc...

-

The deadliest weekend of 2023 so far. Read Today's eNewspaper | Crosswords | ...

-

Friends, I invite you to join the upcoming 2026 Lent Retreat , led by Sr. Miriam James Heidland, in ...