Editor’s Note: Jeff Brown called Nvidia back in 2016 — years before most investors heard of it. He was early on Bitcoin, Tesla, and numerous other technology stocks as well. Now, he has an urgent update on the AI bubble that might surprise you. Click here for the details or read more below.

Dear Reader,

I have an urgent update on artificial intelligence stocks.

Are we in an AI bubble?

Should you take action quickly, before we see a crash?

Lots of respected market voices are saying it’s like the dot-com meltdown all over again.

Where the valuation of AI stocks has far outpaced the actual profits.

In fact, according to JPMorgan, just 30 AI-related stocks make up about 44% of the entire value of the S&P 500.

And the lightning rod for these bubble fears is the AI data center.

These humongous buildings are popping up all over America.

They cost hundreds of millions, even billions of dollars each. Over 8,300 are expected to be in operation by 2030.

Just one data center uses as much energy as a small city.

Nvidia CEO Jensen Huang says over $1 trillion will be spent on AI data centers in the next couple of years.

But what is all of this leading to?

Do we even need all of these data centers?

Right now, AI isn’t showing as much revenue to match the hype.

How long will investors wait before they abandon AI stocks — and the bubble bursts, dragging the American economy down with it?

The time has come for answers to these serious questions.

That’s why we just flew in the foremost expert on AI — and AI data centers.

His name is Jeff Brown.

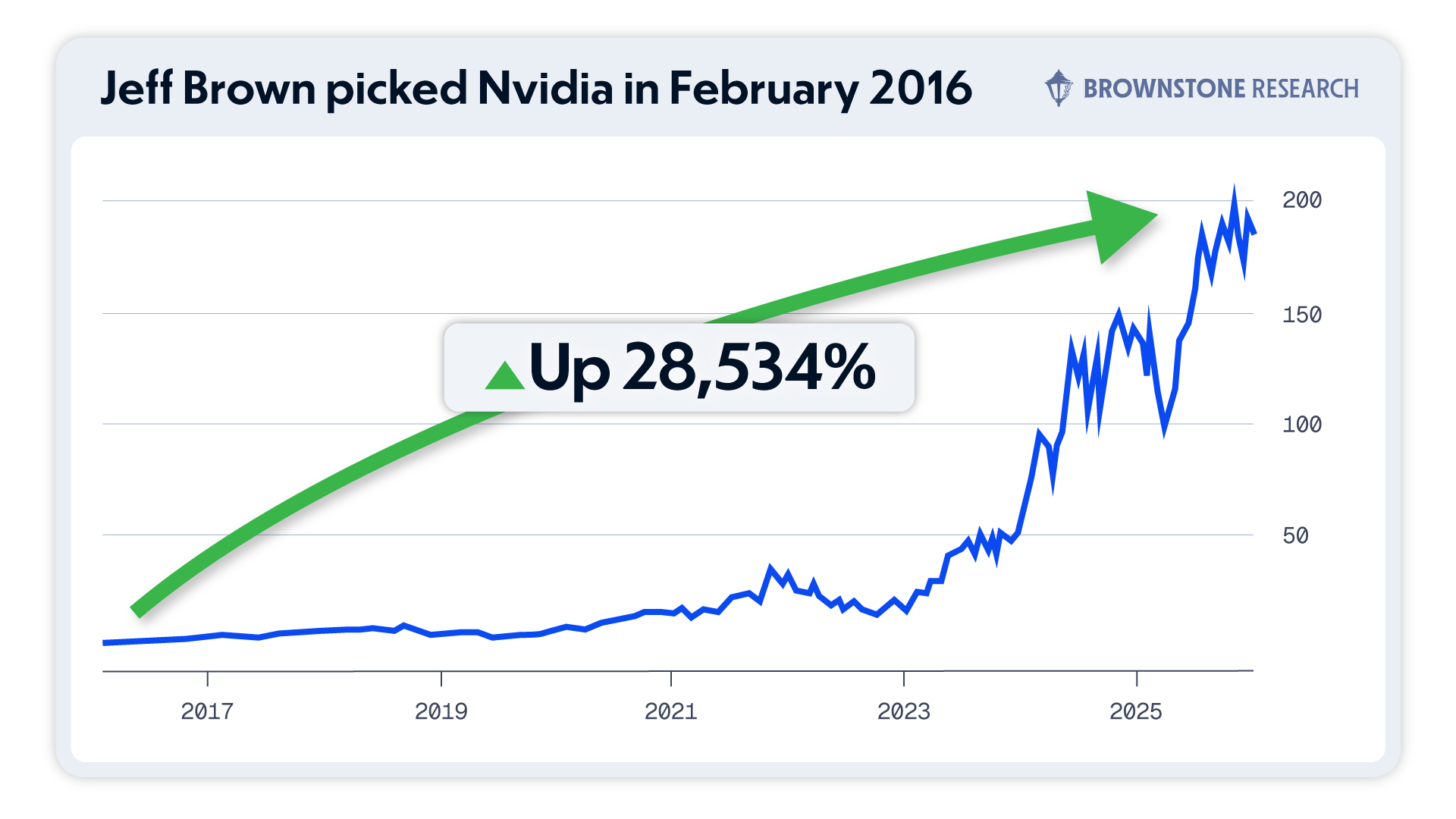

And he was one of the very first to recommend Nvidia as an AI stock, back in February 2016.

Even back then, six years before the release of ChatGPT, Jeff saw the future of AI. And he knew Nvidia’s chips would be at the heart of it.

It recently became the first $5 trillion company in the world.

And the stock is up 28,534% since Jeff recommended it.

In the last couple of years, Jeff has visited AI infrastructure across America.

In fact, he was one of the first to examine Elon Musk’s Colossus data center in Memphis.

Now, in this interview… Jeff will tell us the truth about the AI bubble — and what’s really going on inside these data centers.

Click here to watch this completely free video.

Regards,

Chris Hurt

Host, AI Trojan Horse

P.S. Jeff will also reveal something he’s never publicly shared before.

You see, he believes there’s another hidden use for AI data centers.

A special technology hidden inside.

And it could be 58,000 times more powerful than AI.

Early investors who knew about this technology have already seen gains of 977%... 3,123%... even 5,846% in just 12 months.

This groundbreaking new technology has massive backing from Nvidia… not to mention Microsoft, Google, Amazon — even the U.S. government.

And when you find out what’s really going on inside these AI data centers — it will change the way you view the future of AI.

3 ETFs Designed to Survive the Next Market Crash

Reported by Nathan Reiff. Published: 2/9/2026.

Key Takeaways

- Following a reversal in the precious metals rally, investors looking for defensive plays might consider ETFs that employ strategies to protect against downside risk.

- SPLV and SWAN both provide targeted exposure to the S&P 500 (or portions thereof) while attempting to manage risk using volatility metrics and Treasurys, respectively.

- TLT aims for long-dated Treasurys, attempting to balance a potential yield advantage and minimal credit risk.

Though the stock market has generally continued its upward trend in 2026, signs of strain are emerging. A slowing labor market, the risk of an AI bubble bursting, and a Cyclically Adjusted Price-to-Earnings (CAPE) ratio near 40 suggest a possible correction in an arguably overvalued market.

Many investors seized on the precious-metals rally to shift portfolios toward a more defensive stance. However, a late-January pullback in key metal prices may prompt cautious investors to look for protection elsewhere.

Starlink pre-IPO opportunity with this $30 stock (Ad)

A little-known stock could double as Elon Musk prepares to take Starlink public in what may be the biggest IPO in history. This company is a critical supplier to Starlink's fast-growing satellite network. One analyst believes it's positioned for significant upside as the IPO approaches. You can get the ticker symbol free in the first three minutes of a brief video—no credit card required.

Watch the video to get the ticker nowSeveral exchange-traded funds (ETFs) offer ways to manage downside risk while still providing potential returns or income. Below are three funds, each using a different strategy, that may appeal to investors seeking safety in 2026.

Low-Volatility Names From the S&P 500 for Dividend Stability

Although the S&P 500 can be volatile, some segments of the index tend to be steadier. The Invesco S&P 500 Low Volatility ETF (NYSEARCA: SPLV) targets those members of the S&P with the lowest volatility — it tracks an index of the 100 least volatile S&P 500 constituents based on trailing 12-month volatility.

Unsurprisingly, SPLV's holdings are largely large- and mega-cap blue chips such as The Coca-Cola Co. (NYSE: KO) and McDonald's Corp. (NYSE: MCD), both among the fund's top-10 positions by weight. These companies tend to be relatively stable through economic cycles and typically pay dividends rather than delivering outsized capital gains. As a result, SPLV offers a dividend yield of about 2%.

SPLV is a defensive play: its holdings often underperform growth names during strong bull markets but generally provide downside protection in bear markets.

Its sub-6% return over the past year illustrates that trade-off—stability at the cost of potential for significant upside.

Combining Treasuries and S&P 500 Options for Protected Market Exposure

The Amplify BlackSwan Growth & Treasury Core ETF (NYSEARCA: SWAN), like SPLV, aims to provide S&P 500 exposure while managing downside risk. It pursues this by allocating roughly 90% of assets to U.S. Treasuries and about 10% to in-the-money call options on the SPDR S&P 500 ETF Trust (NYSEARCA: SPY).

The Treasury sleeve offers protection if the S&P 500 declines, while the options component provides uncapped upside participation. SWAN also pays a dividend yield around 2.86%, making it a source of passive income.

Over the past year, SWAN returned just over 10%, modestly below the S&P 500's roughly 13% during the same period. When combined with dividends, many investors may view SWAN's defensive profile—and its 0.49% expense ratio—as an attractive tradeoff for downside protection with some upside potential.

Long-Dated Treasury Fund for Potential Yield

As part of a bond-focused allocation, the iShares 20+ Year Treasury Bond ETF (NASDAQ: TLT) increases exposure to long-dated Treasuries. These securities can offer higher yields but come with greater interest-rate sensitivity, making TLT somewhat riskier than shorter-duration bond funds.

Still, in a market downturn TLT is likely to be far more stable than most equity funds. Its diversification across dozens of issues, a dividend yield of about 4.44%, and a modest 0.15% expense ratio may appeal to defensive investors seeking yield and flight-to-quality characteristics.

Each of these ETFs represents a different way to balance risk and return: SPLV for low volatility and dividend stability, SWAN for principal protection with upside participation, and TLT for yield and safe-haven exposure. Investors should weigh their objectives, time horizon, and tolerance for interest-rate risk, and consider consulting a financial advisor before reallocating.

This message is a sponsored message from Brownstone Research, a third-party advertiser of MarketBeat. Why did I receive this email content?.

If you need help with your account, please don't hesitate to email our U.S. based support team at contact@marketbeat.com.

If you would no longer like to receive promotional emails from MarketBeat advertisers, you can unsubscribe or manage your mailing preferences here.

Copyright 2006-2026 MarketBeat Media, LLC.

345 N Reid Place, Sixth Floor, Sioux Falls, SD 57103-7078. U.S.A..

No comments:

Post a Comment