Below is an important message from one of our highly valued sponsors. Please read it carefully as they have some special information to share with you.

The #1 AI Investment

Elon + Nvidia =

Dear Reader,

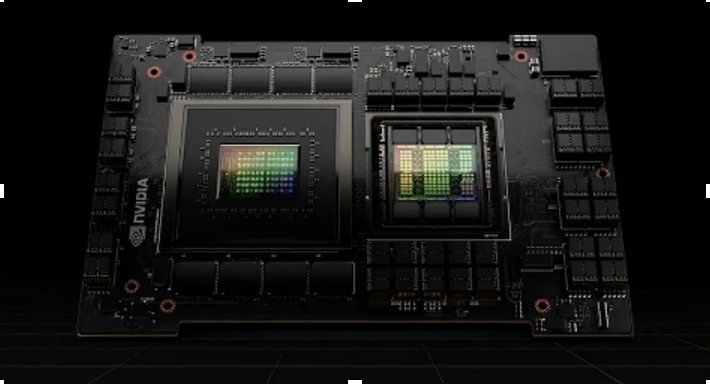

Do you see this weird looking device?

This is Nvidia’s holy grail.

It contains over 3 terabytes of memory…

80 billion transistors…

And can perform over 60 trillion calculations… per second.

This single computer chip goes for $25,000 a pop.

And now…

Elon Musk…

The world’s richest man…

Alongside Nvidia’s CEO Jensen Huang…

Are about to crank it up to 1 million.

At a remote facility in Memphis Tennessee…

You two of them have teamed up with an emerging tech titan…

To build the most advanced AI machine on the planet…

Powered by 1 million of these advanced AI chips.

This Will Unlock the TRUE Power of Artificial Intelligence!

But before you rush out to buy shares of Tesla or Nvidia…

There’s another investment you must consider.

You see, there is ONE company…

That Elon … and Nvidia…

And 98% of the Fortune 500…

Are ALL working with…

To prepare for AI 2.0.

Nvidia’s CEO has even said – this company is ESSENTIAL to their ongoing expansion.

>>>See how you can invest in this revolutionary company today.

Elon is expanding this project RAPIDLY…

And just announced a second AI computer…

That will need this company in order to build.

This may be the single greatest way to build wealth from the AI bull market.

But you must take action immediately.

AI is quickly becoming one of the MAIN focuses in Trump’s new administration…

And once Wall Street sees what this AI can really do — it will be too late.

>>>Go here to learn how to invest in Elon new AI venture.

Regards,

James Altucher

Editor, Paradigm Press

5 Stocks and ETFs to Help Shield Your Portfolio During Volatility

Submitted by Ryan Hasson. Article Published: 2/7/2026.

The U.S. stock market has gotten off to an unsteady start this year. Outside a few defensive pockets—such as consumer staples and energy—most investors have felt the pressure. Elevated volatility, sharp rotations, and growing uncertainty have begun to erode market confidence, and that's often when portfolio positioning matters most.

Periods like this naturally force investors to ask an important question: How exposed am I if the market pulls back further? Whether the current environment becomes a routine correction or something more prolonged, history shows that certain sectors, ETFs, and stocks tend to hold up better than the broader market when sentiment weakens.

Much of the turbulence so far has been driven by technology. After leading the market for years, tech stocks have struggled under the weight of stretched valuations and heavy AI-related capital spending. Software has been hit particularly hard, with the iShares Expanded Tech-Software Sector ETF (BATS: IGV) down nearly 22% year-to-date. That weakness has sparked a broader rotation out of high-growth names and into more defensive areas of the market.

ALERT: Drop these 5 stocks before the market opens tomorrow! (Ad)

The Wall Street Journal is asking whether a stock market crash is coming. Research from Weiss Ratings suggests the first half of 2026 could be very tough for certain stocks as a radical shift hits the market. Some of America's most popular names could take serious damage. Analysts have identified five stocks you should consider avoiding before this event plays out. If these are in your portfolio, you'll want to review your positions carefully.

See the five stocks to avoid and learn what's driving this shift.Adding fuel to the fire are lingering tariff concerns, a weakening U.S. dollar, and a sharp correction in crypto markets. Bitcoin alone has fallen nearly 40% from last year's record highs, amplifying risk-off behavior across equities. When multiple risk assets unwind at once, investors tend to favor durability over upside.

For those looking to play defense or balance growth exposure with protection, the market offers several options that have historically performed well in volatile or declining environments. Some benefit from steady demand regardless of economic conditions, others offer income through dividends, and a few provide both.

Here are five stocks and ETFs investors may want to consider if market volatility persists or deepens.

Healthcare Sector ETF: Defensive Demand Meets Bullish Technicals

Healthcare has long been viewed as one of the market's most reliable defensive sectors, and the current setup reinforces that reputation. The Health Care Select Sector SPDR Fund (NYSEARCA: XLV) provides broad exposure to healthcare giants spanning pharmaceuticals, biotechnology, medical devices, and healthcare services.

The sector's defensive appeal is straightforward: medical care is not discretionary. Regardless of economic conditions, people still need prescriptions, treatments, insurance, and medical equipment. That steady demand helps insulate revenue and cash flow during downturns, making healthcare stocks more resilient than cyclical sectors tied to consumer spending or capital investment.

XLV also offers an income component, with a dividend yield of approximately 1.6%, along with strong liquidity and deep institutional participation. Average daily trading volume consistently exceeds 14 million shares, providing efficient entry and exit points for investors.

What makes XLV particularly interesting right now is its positioning. The ETF has been consolidating for several months in a bullish continuation pattern. The $160 level has served as a key resistance zone since 2024, and the fund now sits just below it. A confirmed breakout would likely attract additional momentum-driven capital.

Fund flows also support the thesis. XLV has recorded positive inflows year-to-date, signaling growing institutional interest as investors rotate toward defensive exposure. From a composition standpoint, the ETF is well-balanced, with roughly 54% exposure to biotechnology, 28% to healthcare equipment and supplies, and 13% to healthcare providers and services.

If volatility remains elevated, healthcare's combination of steady fundamentals and improving technicals makes XLV a compelling defensive allocation.

Johnson & Johnson: A Healthcare Blue Chip with Momentum

Within the healthcare space, few companies embody stability quite like Johnson & Johnson (NYSE: JNJ). The diversified healthcare giant has delivered strong performance this year, with shares up almost 16% year-to-date and nearly 40% over the past six months.

JNJ's defensive characteristics are rooted in its business model. The company operates across pharmaceuticals, medical devices, and consumer health products—categories that experience consistent demand regardless of the economic cycle. That diversification smooths earnings and reduces reliance on any single product line.

In many ways, Johnson & Johnson sits at the intersection of healthcare and consumer staples. Its products are essential, recurring purchases rather than discretionary expenses, making revenue streams more predictable during periods of economic stress.

The company is also a Dividend Aristocrat, boasting a 64-year streak of dividend increases. JNJ currently offers a dividend yield of about 2.2% with a payout ratio around 47%, giving investors both income and balance sheet strength.

Institutional behavior further reinforces the bullish case. Over the past 12 months, Johnson & Johnson has attracted $38.5 billion in institutional inflows versus $25.4 billion in outflows, resulting in meaningful net buying. Wall Street sentiment remains constructive, with a consensus Moderate Buy rating based on more than two dozen analyst opinions.

Consumer Staples ETF: A Classic Defensive Anchor

Consumer staples have historically served as a safe harbor during periods of market stress, and the current environment is no exception. The Consumer Staples Select Sector SPDR Fund (NYSEARCA: XLP) offers exposure to companies that produce everyday necessities—products consumers continue to buy regardless of economic conditions, such as toothpaste, household cleaners, packaged foods, beverages, and personal care items. Demand for these goods tends to remain stable even during recessions, allowing companies like Walmart, Procter & Gamble, and Coca-Cola to maintain consistent revenue and earnings.

That reliability is what gives consumer staples their defensive reputation. During prior downturns, including the 2008 financial crisis, the sector generally outperformed more cyclical areas like technology and financials.

XLP enhances that defensive appeal with diversification and income. The ETF manages close to $17 billion in assets, carries a dividend yield of about 2.45%, and trades nearly 23 million shares per day on average.

From a technical standpoint, XLP has been one of the strongest performers in the market this year. The ETF has surged more than 13% year-to-date, dramatically outperforming the S&P 500, and it recently broke above a multi-year resistance level—signaling a potential regime shift for the sector.

Coca-Cola: Defensive Consistency with Dividend Power

For investors seeking individual stock exposure in consumer staples, Coca-Cola (NYSE: KO) stands out as a high-quality option. The beverage giant has enjoyed a strong start to the year, building on momentum that already made last year one of its best in recent history.

This year's strength appears closely tied to the broader resurgence in consumer staples, which adds credibility to Coca-Cola's move higher. KO's defensive nature stems from its product mix—beverages like Coke, Sprite, and Dasani are affordable, habitual purchases that consumers rarely cut back on, even during downturns. That contrasts sharply with discretionary categories that tend to suffer when sentiment weakens.

Coca-Cola is also a Dividend King, with 64 consecutive years of dividend increases. The stock currently offers a dividend yield of roughly 2.6% and a payout ratio near 68%, making it attractive to income-focused investors.

Analyst sentiment remains favorable. Coca-Cola holds a consensus Buy rating based on 16 analyst opinions, with modest upside still projected. Combined with sector momentum and defensive fundamentals, KO remains well-positioned if market volatility continues.

Vanguard High Dividend Yield ETF: Diversification and Income in One Package

For investors seeking broad diversification and income, dividend-focused ETFs can play an important defensive role. These funds reduce single-stock risk while providing regular cash flow, which can help offset market declines.

One standout option is the Vanguard High Dividend Yield ETF (NYSEARCA: VYM). The fund tracks a diversified basket of high-quality, dividend-paying companies across multiple sectors. With over $73 billion in assets under management and a low expense ratio of just 0.06%, VYM is both efficient and scalable.

The ETF currently yields 2.25% and has outperformed the broader market this year, rising more than 8% year-to-date compared to the S&P 500's modest gains. That outperformance reflects its limited exposure to high-volatility technology stocks and a greater weighting toward defensive, income-generating sectors.

VYM's portfolio is spread across financials (22%), technology (16%), healthcare (13%), consumer staples (11%), and energy (8%), with additional exposure to utilities, materials, and consumer discretionary. The ETF's overall diversification helps smooth returns across different market environments. It's an especially appealing option for investors looking to balance growth exposure with income and downside protection.

Diversification Could Result in Protection and Performance

Market volatility is uncomfortable, but it's also not entirely unpredictable. Every cycle brings periods of uncertainty, and portfolios that account for that reality tend to fare better over time.

Healthcare, consumer staples, and dividend-focused strategies have consistently proven their worth during market pullbacks. Whether through broad ETFs such as XLV, XLP, and VYM, or high-quality individual stocks such as Johnson & Johnson and Coca-Cola, investors have multiple ways to play defense without exiting the market entirely.

As the year unfolds and uncertainty lingers, positioning for resilience may matter just as much as chasing returns.

This email content is a sponsored message for Paradigm Press, a third-party advertiser of MarketBeat. Why did I get this email?.

If you need assistance with your subscription, feel free to contact MarketBeat's South Dakota based support team at contact@marketbeat.com.

If you would no longer like to receive promotional emails from MarketBeat advertisers, you can unsubscribe or manage your mailing preferences here.

Copyright 2006-2026 MarketBeat Media, LLC. All rights reserved.

345 N Reid Pl., Suite 620, Sioux Falls, SD 57103. United States..

No comments:

Post a Comment