ALL THE MONEY NEWS YOU NEED TO KNOW | | | | | | Daniel de Visé | Personal Finance Reporter

| | |

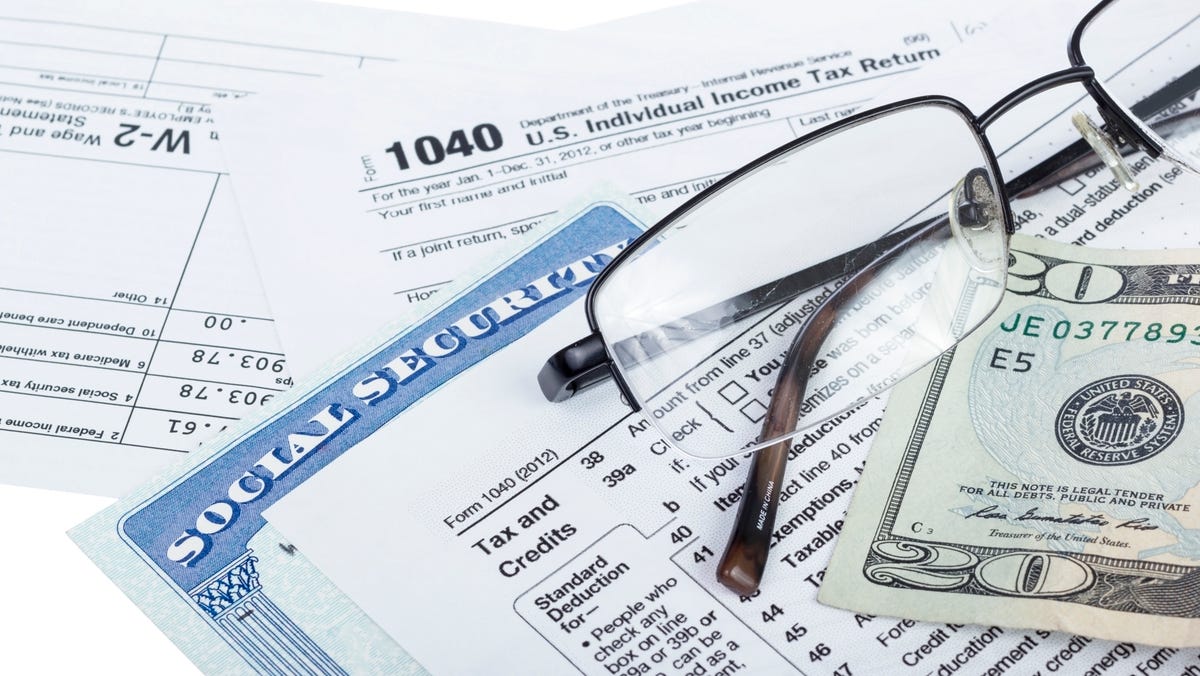

Good morning. This is Daniel de Visé with your Daily Money, Sunday Tax Edition. |

On Sundays between now and April 15, we'll walk you through what's new and newsworthy in Tax Season 2024. |

Let's say your refund check has arrived. You've already spent it, or saved it, several times over in your head. Now, you must decide what to do with the money. |

Here are a few tips from the experts, drawn from a recent story in which we spend (or save) your refund for you. |

Pay down high-interest debt |

Maybe you have credit card debt with a sky-high interest rate of 20% or more. You also have a high-yield savings account with an enviable interest rate of 5%. |

One of those rates is undeniably higher. To some experts, it's a no-brainer: Spend your refund paying down the high-interest debt. The savings account comes second. |

As a rule of thumb, financial advisers suggest most Americans should aim to amass emergency savings to cover three to six months of expenses, if not more. |

That's a lot of money, and not all of us manage to save that much. But, hey, it's a goal. |

Consider high-yield savings or CDs |

Financial planners recommend high-yield savings accounts because that term is no longer an oxymoron. Banks are offering savings accounts that pay serious interest, often in the 4% to 5% range. |

CD rates, too, are the highest they've been in a while. And money market funds can bring considerable rewards. |

Max out retirement savings |

Once you've covered your emergency savings, consider maxing out your retirement savings. |

In 2024, that means saving $23,000 in a 401(k) account, this year's contribution limit. If you're 50 or older, you can save an extra $7,500. |

With an IRA, the current annual limit is $7,000, or $8,000 for people 50 or older. |

This has been a special Sunday Tax Edition of The Daily Money. Each weekday, The Daily Money delivers the best consumer news from USA TODAY. We break down financial news and provide the TLDR version: how decisions by the Federal Reserve, government and companies impact you. | | | | Your refund check has arrived. You've already spent it, or saved it, several times over, but only in your head. Now, you must decide what to do. | | | |  | State tax deadlines are fast approaching. Here are some credits to help you save | | | | 2023 US federal tax bracket guide: Which tax bracket am I in for 2023? What are the new IRS tax brackets for 2024? | | | | Nobody likes paying taxes, but the I.R.S. says it should be smooth and easy for you this year, unless you're a high-income tax cheat. | | | | You might not have to worry about paying a tax bill this year if you qualify for the Saver's Credit. | | | | Maybe you're a planner, your taxes were filed weeks ago and now you're just waiting on the refund. And waiting. Here's why you might wait longer. | | | | The IRS said around 940,000 people in the U.S. need to submit tax returns for the 2020 tax year by May 17. | | | | If you had a Marketplace health plan and received an advance premium tax credit, file your taxes to see if you're due a refund or owe money from it. | | | | Age matters in taxes. When can you take the Child Tax Credit or an extra standard deduction? Here's a list of tax birthdays to mark on your calendar. | | | | Believe it or not, if you've lost your tax return for 2022, you're not alone. People move. Boxes filled with paper get lost. Tax preparers retire. | | | | |  | Sign up for the news you want | Exclusive newsletters are part of your subscription, don't miss out! We're always working to add benefits for subscribers like you. | | | | | | |

No comments:

Post a Comment