ALL THE MONEY NEWS YOU NEED TO KNOW | | | | | | Medora Lee | Money and Personal Finance reporter

| | | What is capital gains tax? Here's what to know about long-term vs short-term rates before filing.

|

Good morning. This is Medora Lee with your Daily Money, Sunday Tax Edition. |

On Sundays between now and April 15, we'll walk you through what's new and newsworthy in Tax Season 2024. |

An HSA is more flexible because money can be invested to grow and unused money rolls over indefinitely. However, you can only use the HSA if you have a high-deductible health plan. For 2023, the maximum HSA contribution is $3,850 for an individual and $7,750 for a family, but participants 55 and over may contribute an extra $1,000. That means an older married couple could contribute $8,750, all pre-tax. |

An FSA is a use it or lose it account. Generally, you have a year to use up all the money in the account on eligible care or you lose it - unless your employer offers an exception. The good news is that the list of things you can use the money for has grown over the years to include even everyday items like Tylenol, sunscreen, menstrual care, contact lenses and glasses, massage guns, breast pumps and more. For 2023, participants may contribute up to a maximum of $3,050. |

Education is expensive, but the government offers several ways to soften the blow. |

American Opportunity Tax Credit : AOTC can reduce how much you owe in taxes by up to $2,500, depending on your income (or that of your parents), per student. In some cases, the credit may be refundable. If the credit brings what you owe to the IRS to $0, you can have up to 40% of the remaining amount refunded to you, up to a maximum of $1,000. AOTC gives you credit for 100% of the first $1,000 of qualified education expenses. After that, you get credit for 25% of the next $2,000 of qualified education expenses. Qualified expenses include tuition, fees and required course materials (like textbooks). |

Lifetime learning tax credit : With LLTC, you can claim a credit for 20% of up to $10,000 spent on qualified tuition and education expenses paid for eligible students enrolled in a qualifying college or educational institution. There is no limit on how many years you can claim the credit, making it especially useful for students in graduate school, continuing education programs or those who are completing certificate programs. However, unlike AOTC, it's worth up to $2,000 per tax return—not per student -- and it's not refundable. |

529 plans: You can fund these investment plans each year up to a limit while your child is still young. You use after-tax money, but some states (each state has its own plans and rules) offer a state tax break on contributions. When you're ready to use the money for qualified educational expenses like tuition, books, school supplies and room and board, withdrawals are tax free. | State- and school-sponsored 529 plans are popular options when saving for college expenses. Getty Images / FlamingoImages |

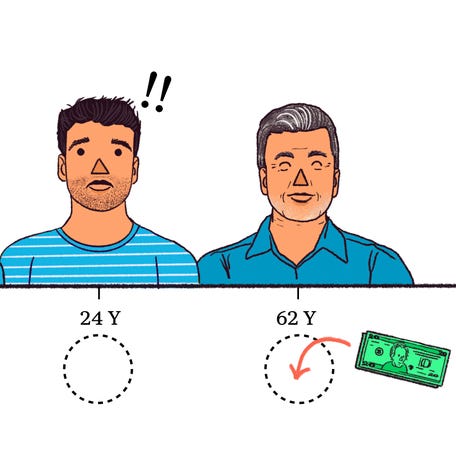

This has been a special Sunday Tax Edition of The Daily Money . Each weekday, The Daily Money delivers the best consumer news from USA TODAY. We break down financial news and provide the TLDR version: how decisions by the Federal Reserve, government and companies impact you. | | | | If you had a Marketplace health plan and received an advance premium tax credit, file your taxes to see if you're due a refund or owe money from it. | | | |  | If you win the Mega Millions jackpot, be quiet and don't post on social media. Hire a lawyer, accountant and financial adviser first to hatch a plan. | | | | What is capital gains tax? Here's what to know about long-term vs short-term rates before filing. | | | | Age matters in taxes. When can you take the Child Tax Credit or an extra standard deduction? Here's a list of tax birthdays to mark on your calendar. | | | | Believe it or not, if you've lost your tax return for 2022, you're not alone. People move. Boxes filled with paper get lost. Tax preparers retire. | | | | Tax refunds continue to arrive for early filers. The good news for some is the average tax refund issued so far is $3,182, which is up from last year. | | | | Tax season is well underway in the US and if you've got plans for that tax return and waiting with baited breath for it to arrive, you're not alone. | | | | What is a federal tax credit? Here's how it works and what makes it different from a tax deduction. | | | | 2025's COLA estimate rose to 3.1% after hotter February inflation data. However, it's still below 2024's 3.2% bump and leaves seniors struggling. | | | | President Joe Biden announced plans to tax corporations and those making over $400,000, in an effort to lower the country's financial deficit. | | | | |  | Sign up for the news you want | Exclusive newsletters are part of your subscription, don't miss out! We're always working to add benefits for subscribers like you. | | | | | | |

No comments:

Post a Comment